Investor Perception

Horizon Minerals’ near-term cash-flow potential and its vital land bundle within the prolific Western Australian goldfields with appreciable exploration upside place the corporate to positively leverage the present bull gold market alternative.

Overview

Horizon Minerals (ASX:HRZ) is an ASX-listed rising mid-tier gold mining firm specializing in a portfolio of extremely promising gold initiatives positioned within the world-class Western Australian goldfields. The current merger with Greenstone has added almost 0.5 million ounces (Moz) of high-grade useful resource to Horizon, taking its whole tally to 1.8 Moz, and resulted in Horizon Minerals whole land bundle of 939 sq km within the Kalgoorlie-Coolgardie district.

The merger brings near-term cash-generating alternatives and provides better scale to its baseload property (Boorara) with the high-grade Burbanks deposit. Horizon’s dual-track technique entails producing quick money flows by leveraging a pipeline of development-ready manufacturing property and concurrently advancing the cornerstone property, Boorara and Burbanks, which have a mixed useful resource stock of 914 koz at 1.7 grams per ton (g/t) gold with potential to assist a worthwhile, long-life operation.

The current ore sale settlement with Paddington Gold is encouraging and will increase confidence within the administration’s skill to generate near-term money flows. Below the settlement, 1.4 million (Mt) will probably be processed over a interval of twenty-two months. The settlement permits Horizon to capitalize on excessive gold costs to generate vital money flows.

Horizon can be progressing with different initiatives, together with the Cannon gold mission and Penny’s Discover underground mine, and actively exploring for brand new discoveries within the Western Australian Goldfields, focusing on gold and different commodities similar to nickel-cobalt, silver-zinc, PGEs and lithium throughout its intensive land holdings. Moreover, Horizon holds a big stake in one of many world’s largest vanadium initiatives by way of its funding in Richmond Vanadium Expertise, which is listed on the ASX.

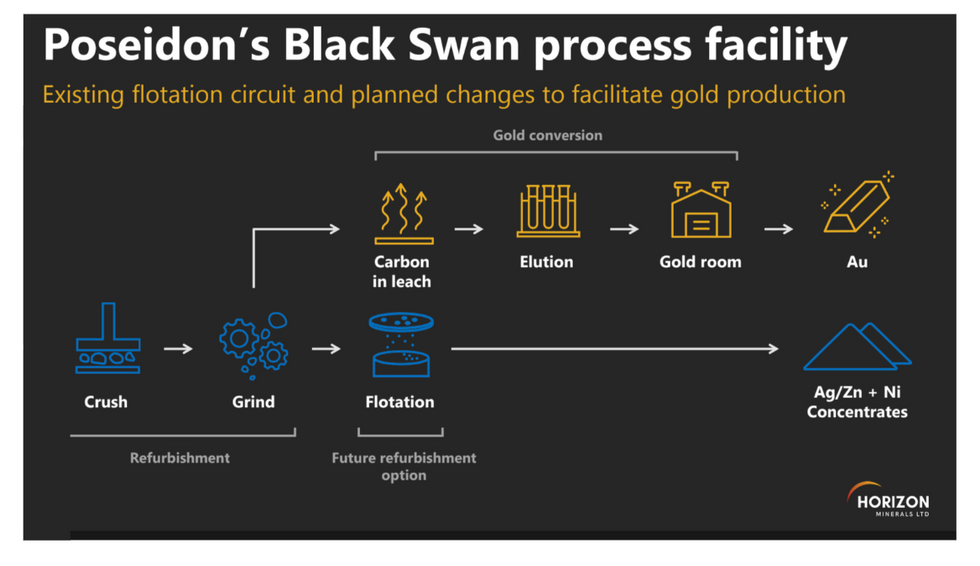

Horizon proposes to amass one hundred pc of Poseidon by way of an all-scrip transaction for AU$30 million to consolidate 1.8Moz gold and extremely strategic processing infrastructure for Horizon to transition to the following standalone WA gold producer. The acquisition will mix Horizon’s giant gold useful resource and Poseidon’s Black Swan processing infrastructure within the Kalgoorlie-Coolgardie districts. The transaction will additional lead to substantial useful resource base and regional tenure to a mixed JORC mineral assets of ~1.8Moz gold at a median grade of 1.84g/t gold and 422,700t nickel at a median grade of 1 p.c nickel. Horizon and Poseidon can have a complete of 1,309 sq. km. tenure in a gorgeous geological place within the WA Goldfields.

Horizon goals to turn out to be a sustainable, 100kozpa standalone producer following the merger and conversion and recommissioning of the Black Swan processing plant. The two.2Mtpa processing facility is strategically positioned 40 km north of Kalgoorlie with a concentrator readily amenable to processing gold by way of cost-effective refurbishment and the addition of a brand new CIL circuit.

Horizon’s 30Mt current gold assets, with 50,000 metres of drilling totally funded to start drilling in 2025 or 2026, strongly assist the conversion of the Black Swan processing plant to a gold plant.

Firm Highlights

- Horizon Minerals is an rising mid-tier gold producer with an in depth portfolio of extremely promising gold initiatives positioned within the world-class Western Australian goldfields.

- The lately introduced merger with Greenstone Assets positions Horizon as a mid-tier gold producer within the Western Australian Goldfields. The mixed entity enhanced Horizon’s portfolio with two complementary cornerstone gold property — Burbanks and Boorara (mixed useful resource of 914,000 oz).

- Mineral useful resource updates after the merger embody 1.8Moz gold, 20.2Moz silver, 104kt zinc, 283kt nickel, 40.5kt cobalt and 296.2kt manganese.

- Adjustments to the gold MREs embody:

- Addition of 297,650oz from Burbanks open pit

- Addition of 167,920oz from Burbanks underground

- Addition of 13,000oz from Pinner

- Addition of three,000oz from Monument

- Discount of 20,240oz from Boorara

- Open pit mining has commenced on the Boorara gold mission on August 2024 and the primary ore was uncovered and mined in late September 2024.

- Horizon can be progressing with different initiatives, together with the Cannon and Penny’s Discover underground mines.

- Amidst the present report gold costs, Horizon seeks to capitalize on this chance by advancing its substantial useful resource endowment in the direction of improvement, thereby producing money move.

Key Tasks

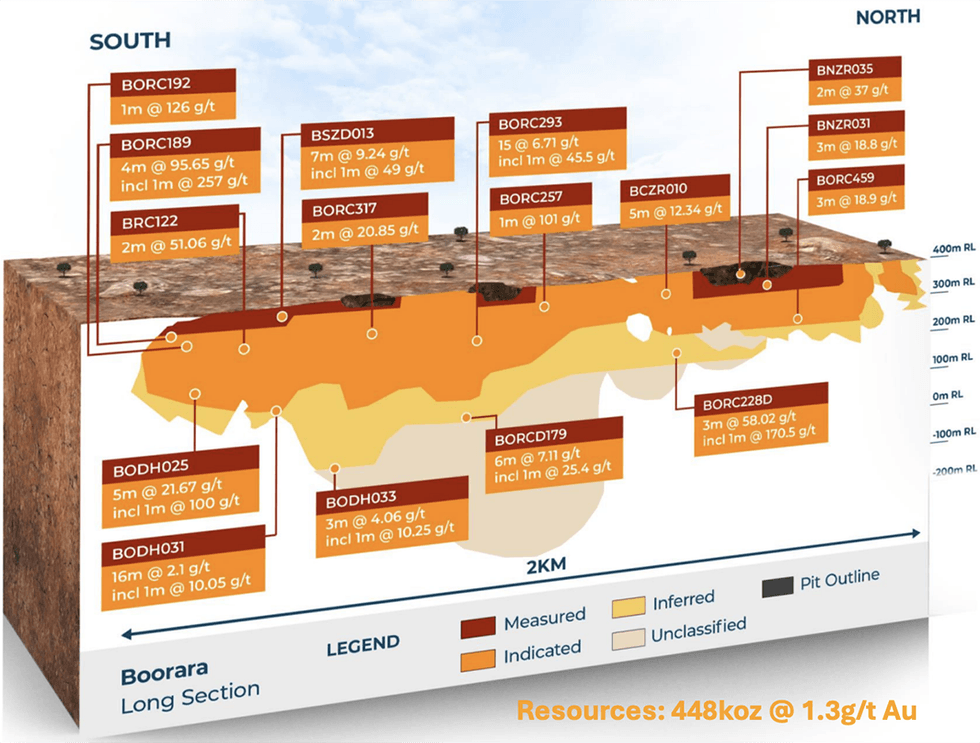

Boorara Gold Challenge

The Boorara gold mission is positioned 15 km east of Kalgoorlie-Boulder within the Western Australian goldfields. Over the previous decade, a considerable quantity of reverse circulation and diamond drilling has been carried out at Boorara. The mission features a JORC 2012 mineral useful resource estimate (MRE) by Optiro (now Snowden Optiro), which reported a complete of 11.03 Mt grading at 1.26 g/t gold, amounting to 448,000 ounces.

The corporate views Boorara as a considerable baseload feed supply that may very well be enhanced by decrease tonnage, higher-grade feed to maintain a standalone milling facility. That is the place the current acquisition of Greenstone turns into vital. Boorara could be supplemented by higher-grade feed from Greenstone’s Burbanks deposit to assist an built-in operation.

The Unbiased JORC (2012) Ore Reserve for Boorara, accomplished by AMC Consultants, exhibits a financially viable mission highlighted by an open pit mine design producing 1.24 Mt at a totally diluted grade of 1.24 g/t gold for 49.5 koz over an approximate 14-month mine life, and ore sale settlement at 92.5 p.c metallurgical restoration produces 45.8 koz recovered.

Nimbus Silver-Zinc Challenge

The one hundred pc owned Nimbus silver-zinc-lead-gold deposit is positioned 15 kilometres east of Kalgoorlie-Boulder in Western Australia throughout the Kalgoorlie Terrane. The mission’s present mineral useful resource estimate (JORC 2012) contains 12.1 million tons at 52 g/t silver, 0.2 g/t gold and 0.9 p.c zinc containing 20.2 million ozof silver, 78,000 ozof gold and 104,000 tons of zinc utilizing decrease cut-off grades of 12 ppm for silver, 0.5 p.c for zinc and 0.3 g/t for gold over a 2 metre down gap composite. Inside this international useful resource, the Nimbus mission has a high-grade silver and zinc useful resource of 255,898 tons at 773 g/t silver and 13 p.c zinc.

An idea research has confirmed the optimum financial improvement pathway by mining the higher-grade lodes and era of a silver/zinc focus. A programme of labor (POW) has been accredited and drilling to check the exploration goal is predicted to be undertaken within the first half of 2025. The Nimbus mission is 2 km east of Horizon’s cornerstone Boorara mission and 6.5 km north-northwest of Golden Ridge, each historic gold mining centres.

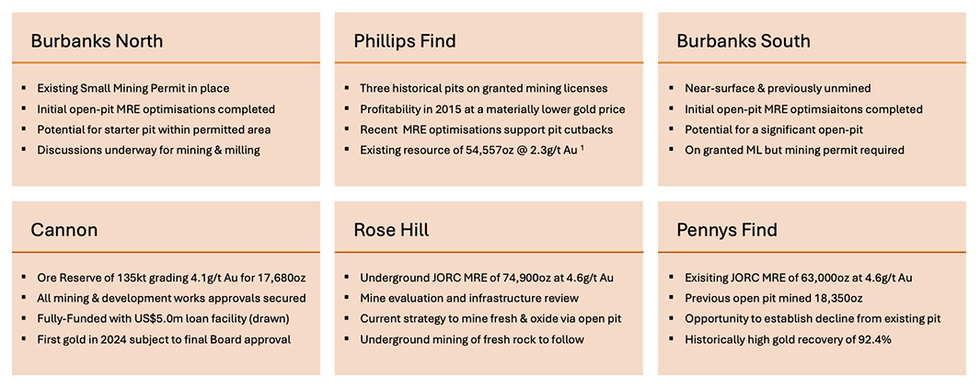

Burbanks Gold Challenge

The Burbanks gold mission is located 9 km southeast of Coolgardie, Western Australia. The mission encompasses the Burbanks Mining Centre and greater than 5 kilometers of the extremely promising Burbanks Shear Zone, traditionally essentially the most vital gold-producing construction throughout the Coolgardie Goldfield. Earlier underground manufacturing at Burbanks has surpassed 420,000 ozto date.

Burbanks presently hosts a complete useful resource of 6.1 Mt @ 2.4 g/t gold for 466 koz, together with underground of 1.2 Mt @ 4.4 g/t gold for 168 koz. Burbanks is underexplored and stays open in all instructions for future development.

Cannon Underground Challenge

The Cannon gold mission is positioned 30 km east-southeast of Kalgoorlie-Boulder. It’s a totally permitted mission with a pre-feasibility research accomplished in 2022, which exhibits sturdy mission economics with a free money move of AU$10.1 million over the mine’s life. The corporate has completed commissioning a dewatering pipeline and a pumping system, representing a significant milestone within the development of its Cannon Underground mission. Discussions with mining contractors and potential JV mining companions are underway. First ore manufacturing from the Cannon Challenge is predicted to start in This autumn 2024.

Penny’s Discover

Penny’s Discover is about 50 km northeast of Kalgoorlie within the Jap Goldfields of Western Australia, close to the corporate’s wholly-owned Kalpini gold mission. It includes a granted mining lease and different related leases protecting 91 hectares. The mineral useful resource estimate up to date in December 2023 boasts 63,000 ounces of gold within the indicated and inferred class. A pre-feasibility research for exploitation utilizing underground mining strategies is presently underway. This research will embody mine design and monetary evaluation.

Rose Hill

Rose Hill is 0.5 km southeast of Coolgardie and 35 km west of Kalgoorlie-Boulder, on the western fringe of the Archean Norseman-Menzies Greenstone Belt. The present JORC 2012 useful resource at Rose Hill accommodates 93,300 oz , comprising an open-pit mineral useful resource of 0.3 Mt grading 2.0 g/t gold for 18,400 oz, and an underground mineral useful resource of 0.5 Mt grading 4.6 g/t gold for 74,900 oz. Practically 70 p.c of the useful resource is within the measured and indicated JORC classes.

Kalgoorlie Regional

Horizon owns a number of promising tenements throughout the Kalgoorlie area. These mission areas embody the better Boorara-Cannon mission space, Lakewood, Binduli-Teal mission space, Kalpini, Balagundi-Kanowna South and Black Flag.

Coolgardie Regional

Horizon manages a number of promising tenements throughout the Coolgardie area, together with Rose Hill, Sensible North and Yarmany.

Administration Staff

Ashok Parekh – Non-executive Chairman

Ashok Parekh has over 33 years of expertise advising mining corporations and repair suppliers within the mining business. He has spent a few years negotiating mining offers with publicly listed corporations and prospectors, resulting in new IPOs and the initiation of recent gold mining operations. Moreover, he has been concerned in managing gold mining and milling corporations within the Kalgoorlie area, the place he has served as managing director for a few of these corporations. Parekh is well-known within the West Australian mining business and has a extremely profitable background in proudly owning quite a few companies within the Goldfields. He was the chief chairman of ASX-listed A1 Consolidated Gold (ASX:AYC) from 2011 to 2014. He’s a chartered accountant.

Warren Hallam – Non-executive Director

Warren Hallam is presently a non-executive director of St Barbara Restricted and Poseidon Nickel Restricted, and non-executive chairman of Kingfisher Mining Restricted. Hallam has a constructed a powerful monitor report over 35 years in operations, company and senior management roles throughout a number of commodities. This contains earlier Managing Director roles at Metals X Restricted, Millenium Metals Restricted and Capricorn Metals Restricted. Hallam is a metallurgist with a Grasp in Mineral Economics from Curtin College.

Chris Hansen – Non-executive Director

Chris Hansen is a multidisciplinary metals and mining skilled, combining core technical fundamentals with a powerful finance and mission improvement mind-set. Having initially targeted on constructing a stable technical basis with business majors similar to Fortescue Metals Group and Barrick Gold, Hansen later joined a pre-eminent London-based mining personal fairness fund creating strong funding expertise, mission improvement experience, market information and robust business relations. Since returning to Australia, Hansen has leveraged his expertise in each private and non-private markets, most lately having led mining enterprise improvement actions for one in all Australia’s largest personal funding teams. He holds a BSc in geology from the College of Auckland, and an MSc in Mineral Economics from Curtin College.

Grant Haywood – Managing Director and Chief Government Officer

Grant Haywood brings over three a long time of expertise in each underground and open-cut mining operations. Throughout his profession, he has served in senior management capacities in numerous mining corporations, guiding them from feasibility by way of to improvement and operations. His expertise spans numerous roles inside junior and multinational gold mining corporations, predominantly within the Western Australian goldfields, together with positions at Phoenix Gold, Saracen Mineral Holdings, and Gold Fields. He’s a graduate of the Western Australian Faculty of Mines (WASM) and has additionally earned a Masters in Mineral Economics from the identical establishment.

Julian Tambyrajah – Chief Monetary Officer & Firm Secretary

Julian Tambyrajah is an achieved international mining finance government with greater than 25 years of business experience. He’s an authorized public accountant and chartered firm secretary. He has served as CFO of a number of listed corporations together with Central Petroleum (CTP), Crescent Gold (CRE), Rusina Mining NL, DRDGold, and Dome Assets NL. He has intensive expertise in capital elevating, a few of which incorporates elevating US$49 million for BMC UK, AU$122 million for Crescent Gold and AU$105 million for Central Petroleum.

Glenn Poole – Chief Geologist

Glenn Poole is a geologist with 15 years’ expertise in exploration and manufacturing environments, having principally labored inside orogenic gold programs for a number of main mining corporations in Western Australia. Poole brings intensive expertise in structurally managed slim vein gold and sulphide-associated gold deposits. He has beforehand held senior administration roles with main Australian gold producer, Northern Star, throughout which era, he performed a pivotal function within the identification and definition of recent ore assets and mining fronts at each the Paulsens and Kundana operations. Most lately, Poole was the senior geologist at Firefly Assets (ASX:FFR), principally chargeable for setting exploration technique and main the definition of the maiden JORC 2012 useful resource at Yalgoo. Poole holds a Bachelor of Science Geology & Geography from The College of Otago, and a Grasp of Enterprise Administration from La Trobe College.